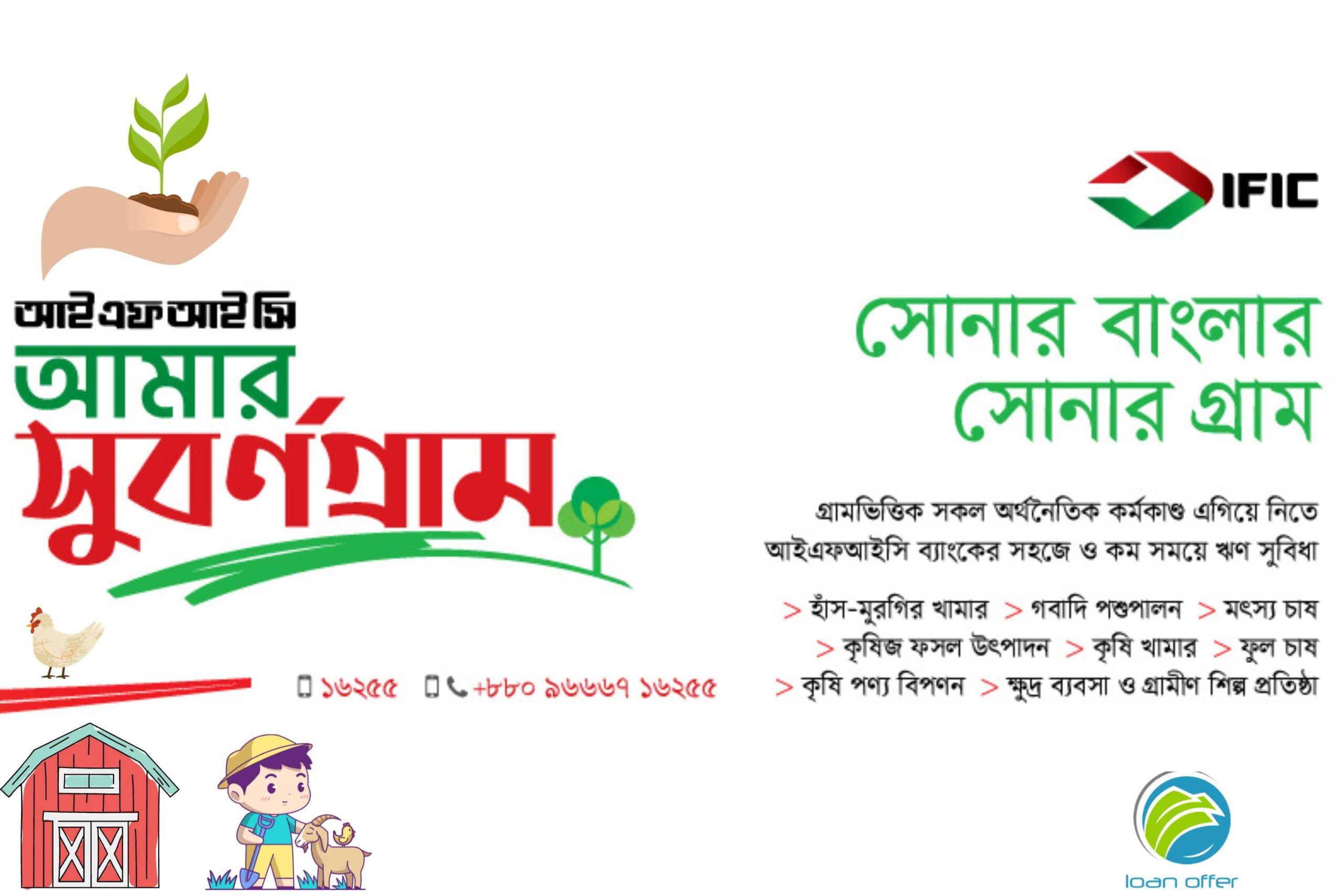

IFIC Aamar Subornogram

IFIC Aamar Subornogram: Empowering CMSME Sector Introduce the IFIC Aamar Subornogram, a financial assistance program designed to cater to the needs of Cottage, Micro, Small, and Medium Enterprises (CMSMEs). This program is specifically tailored to support the growth and development of businesses in these sectors, contributing to the overall economic growth of the country. What … Read more