LankaBangla Finance Shikha Loan

The Shikha Loan for Women Entrepreneurs, also known as Anonnya Women Entrepreneur Installment Loan, is a financial product aimed at supporting female entrepreneurs in Bangladesh. Despite facing challenges, women in Bangladesh have made significant progress and are actively contributing to the socioeconomic development of the country. However, they often lack access to credit, skills training, and market opportunities.

LankaBangla Finance has introduced the Ananya installment loan tailored specifically for women entrepreneurs in SMEs. This loan product covers various sectors such as printing, packaging, boutique houses, beauty parlors, manufacturing, and trading.

Features of LankaBangla Shikha Loan

- Loan amount: up to BDT 5.0 million

- Repayment tenure: Up to 60 months

- Payment mode: Equal monthly installment

- Dedicated Desk: Each branch has a dedicated Desk to support the product

- e-Statement: Monthly e-statement facility

Charges & Fees:

- Loan Processing Fee: (Secured/Lease/Partial Secured Loan) at actual plus 15% VAT

- Early/partial Settlement Fees: 2.0% on the outstanding principal amount

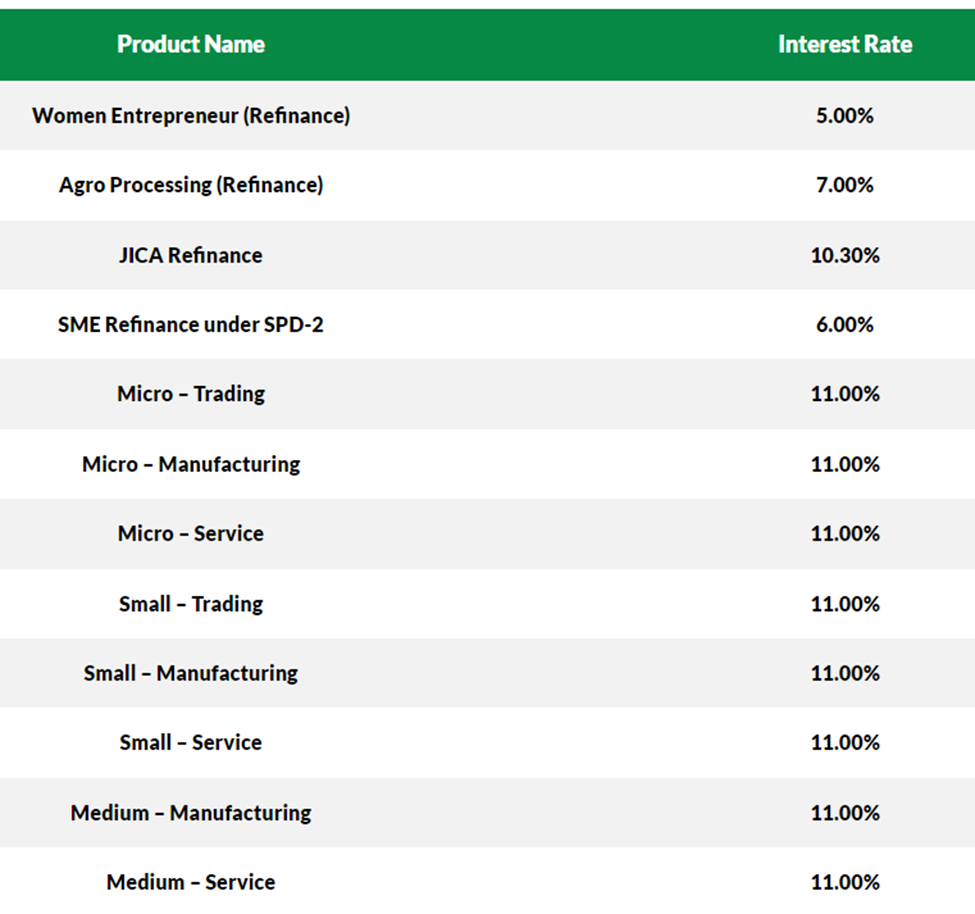

Interest Rate of SME Financial Services

Eligibility of LankaBangla Shikha Loan

Any Bangladesh Citizen:

- Age limit: Minimum 21 years, Maximum 60 years at loan maturity

- Involvement: Must be actively involved in business.

Required Documents to apply for LankaBangla Shikha Loan

Here are the documents you need to submit when applying for a Shikha loan from Meghna Bank.

Required Documents:

- Updated Trade License copy

- Recent Photographs of Applicant and guarantor(s)

- National ID card/Passport/Driving License of Applicant and Guarantor(s) Trade License, E-TIN

- Bank statement for the last 12 (Twelve) months

- Copy of Utility bill e.g., electricity, gas, and others

- Rental deed copy

- Land Documents (if applicable)

FAQs about LankaBangla Finance Shikha Loan

Q: What are the criteria for getting an SME Finance Loan?

A: To avail an SME Loan, you should fulfill the following criteria:

- Be a Bangladeshi citizen.

- Have been a self-businessman for at least two years.

Q: What is the minimum loan limit of the LankaBangla Shikha Loan?

A: The LankaBangla Shikha Loan offers an unsecured loan up to BDT 2.5 million.

Q: What is the maximum loan limit of the LankaBangla Shikha Loan?

A: The LankaBangla Shikha Loan provides partially secured or fully secured loans above BDT 2.5 million.

Q: What is the loan tenure of the LankaBangla Shikha Loan?

A: The loan tenure for the LankaBangla Shikha Loan can extend up to 60 months.

Q: What is the interest rate of a Personal Loan?

A: The interest rate for a Personal Loan ranges from 5.00% to 11.00%.

Q: What is the customer’s age limit for a Personal Loan?

A: The minimum age to qualify for a Personal Loan is 21 years, and the maximum age at the time of loan maturity is 65 years.

Q: Is there any option to increase your Loan?

A: Yes, there are options available to increase your loan.

Q: What is the LankaBangla Shikha Loan disbursement mode?

A: Loan disbursement is made by crediting the customer’s savings account with Meghna Bank.

Q: Can I get a monthly e-statement facility for personal loans?

A: Yes, you will receive an e-statement facility for personal loans.

Q: How to contact LankaBangla Shikha Loan for Loans?

A: You can contact Shikha Focal Point, Sharmin Sultana, FAVP, Head of Liability Operations, at shikha@lankabangla.com. The corporate head office is located at Safura Tower (Level 11), 20 Kemal Ataturk Avenue, Banani, Dhaka. You can also reach them at (+88 02) 222283701-10 or info@lankabangla.com.

1 thought on “LankaBangla Finance Shikha Loan”