Bangladesh krishi bank services offered in Bangladesh

Banks provide many services in modern times. Because nowadays banks have to attract their customer’s lot. Although there are basic banking services that all banks provide. So, these basic services are common services for all banks. Here will discuss about Bangladesh Krishi Bank services.

Bangladesh Krishi Bank provides the following services:

- Online Banking of their customers

- ATM service under the Q-Cash network

- SMS banking

- BACH service

- Real Time Gross Settlement (RTGS) Service

- Small and Mid-size Enterprise (SME)

- School Banking

- Utility Bill service

- Locker service

- Elder and Widow allowance service

Bangladesh Krishi Bank Online Banking Service

Online banking is the method of allowing customers to conduct financial transactions over the Internet.

Online banking is also known as internet banking or web banking. A customer can perform all services like deposit transfer, online bill payment, etc. Every banking institution has some form of online banking such as a desktop version and mobile app. Here the core banking solution of Bangladesh Agricultural Bank is networking all branches. Customers can operate account, and banking services in all branches, and maintain accounts through CBS. Bangladesh Krishi Bank is providing online banking services in its 1038 branches.

Key features:

- Real-time centralized management service

- Any branch withdrawal and the deposit facility

- All transaction notifications

- 24/7 banking through an ATM machine

- NPSB facilities

Bangladesh Krishi Bank Q-Cash ATM service

There are 8 ATM booths of Bangladesh Krishi Bank under the Q-cash network. BKB offers their all customer a debit card and gives free access to the customers 24/7. Customers can avail of the point-of-sale service through a debit card at any shopping mall, megamall, hospital, hotel, and restaurant.

The debit card has a transaction limit at ATM booths and other transactions. Limits are given below:

- Daily limit: 1,00,000

- Maximum transaction: 5 (20,000 each for 5 transactions)

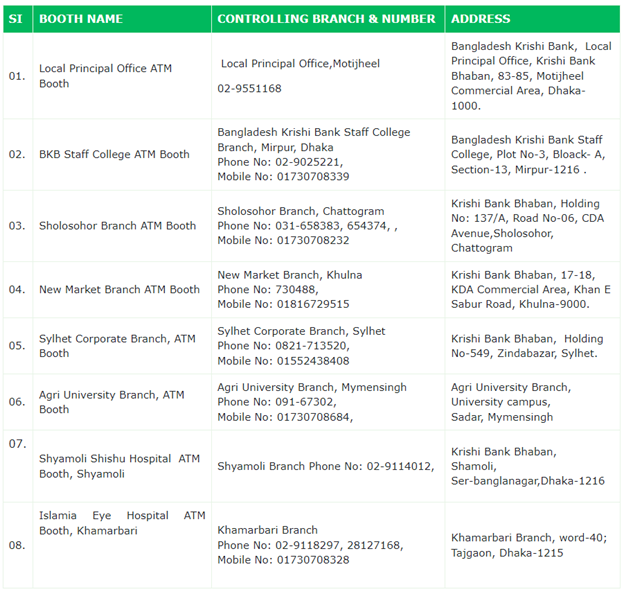

ATM booths locations

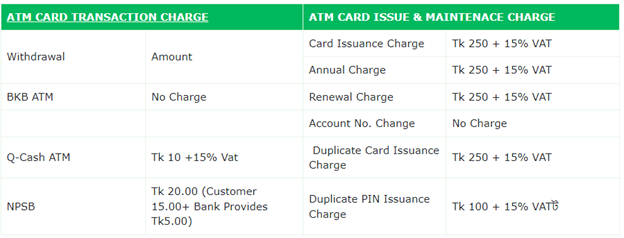

ATM card-related charges

Customer awareness of ATM use booths

- Customers need to inform the card department when a card is stolen or lost

- Customers should examine ATM machines, cards, readers, cash dispensers, and cars or cash-trapping devices carefully.

- Careful about extra cameras beyond the ATM booth

- Report the confiscated card immediately, if you can don’t leave the machine.

- Be aware of the following link in the email which asks you to change the PIN code

- Never write the PIN code in any plain text on the card or in the card.

Short Message Service (SMS) banking

Ensuring secure customer service is the top priority. With this goal in mind, SMS Banking has come up with services so that customers can fulfill their banking needs from anywhere and anytime. A customer can get information related to his account like check balance, view the last transaction, checkbook order, email id update, and more. It enables you to send and receive textual information anywhere 7 days a week and 24 hours a day.

Key features of the SMS banking

- Safety: all transactions above a value desired are intimated to you as and when they happen, so you are always kept updated on your transactions.

- Convenience: You can check your account balance from the SMS service.

- Updates: Get automatic updates on deposits/ loan installment and new products

- Availability: The service is available from anywhere and anytime

- Offer: SMS banking offers:

- Balance Enquiry

- Account information

- Mini Statement

- Help service

BACH service of the Bank

Bangladesh Bank’s project of automating the payment system of the country is named Bangladesh Automated Clearing House (BACH). The BKB is an active member of BACH and serves 94 branches with this bank. The BACH is divided into two parts:

- BACPS (Bangladesh Automated Cheque Processing System)

- BEFTN (Bangladesh Electronic Funds Transfer Network).

Real Time Gross Settlement (RTGS) service

The RTGS service is a funds transfer system where the transfer of money or securities takes place from one bank to another on in real-time and gross basis. The Gross settlement means the transaction is settled on one to one basis without bunching any other transaction.

Small and Mid-size Entrepreneur (SME) service

Bangladesh Krishi Bank has introduced SME policy strategies and financing norms in accordance with industrial policy and Bangladesh Central Bank.

SME interest rate:

- Term Loan: 15.00%

- Credit/ Working capital loan: 15.50%

- Women Entrepreneur: 15.00%

Bangladesh Krishi Bank School Banking

BKB school banking is a special type of banking for school-going children and their parents to know about banking helps to make a habit of saving from an early age of children. A School banking account is a savings deposit account heading in the `name of the student and to be operated jointly with guardians.

Some rules of school banking:

- Applicant age: 6 to 18 years

- Management account: This account will be managed by the parents

- Filling form: Both student and parent will fill out the form

- Account type: This is a savings account

- Opening balance: Minimum 100 taka

- Nationality: Should be Bangladeshi student and parent

- Required documents: Copy of Birth certificate, academic certificate, and transcripts

- Fee or charge: This account will be an exercise of government fee only

- Deposit of scholarship and stipends: Students will deposit the amount from the scholarship or stipend into their account

- Education insurance: Students will get the education insurance facility under this account.

Utility Bill Collection

Utility bills, like any kind of bill, can be sent to collections. Utility Bill collection Service provides utility service providers with an easy solution to collect their dues.

Locker Service

Locker service is a strong security architecture of the bank where the customer’s valuables assets are kept. Locker service. Now a very profitable service for the bank which makes it easy to protect the valuable assets of the customer.

Elder/ Widow Allowance

This bank provides elder/ widow allowance services to the Bangladesh government.

Frequently Asked Questions (FAQs) for Bangladesh Krishi Bank Services

What is SMS Banking?

- SMS Banking is a service that allows you to perform banking transactions on your mobile phone via SMS.

Can I avail the of SMS Banking service from outside my country?

- If you have international roaming activated on your mobile, you can perform SMS Banking activities from anywhere abroad.