Green banking is a type of banking that provides sustainable financial services conducted in ordinary banking services. Green Banking Green finance is used to promote sustainability in the following special areas to provide sustainable financial services:

- Companies and individuals committed to environmental responsibility in their lending

- Provide investment products that align with investor values, such as renewable energy quotas or carbon offsets

- Reducing operational emissions through its operations.

What is green banking?

Green banking is an environment-friendly banking trend in which financial institutions invest in their customers to focus on sustainable technologies and environment-friendly initiatives. These financial institutions, through their customers, are dedicated to sustainable banking initiatives that promote clean energy and combat climate change. As we all know it became hugely popular among banks after the Paris climate agreement and has been promoting carbon offsets, renewable energy, and reforestation project investments ever since. So green banking can be a good opportunity to diversify the bank business and also a golden opportunity for the customers as a customer is getting the loan facility with easy and simple interest. Banks can be greener at a more local level by enacting eco-friendly lending policies.

Green banks can go green at a more local level by not only investing in climate resilience projects but also by enacting eco-friendly lending policies.

Green Banking Practices

Green Lending – Green lending is the practice of financing a project or initiative that has certain environmental benefits. Technically domestic biogas plants, these projects are often in the renewable energy, sustainable housing, and recycling sectors.

Green Banking – Green banks typically work to provide loans for sustainable agriculture, renewable energy, or life-saving projects. That’s why other banks may have trouble qualifying with lenders. Banks promote financial literacy among low-income families so that they can become financially independent, while also contributing to building a strong economy. At the same time can extend lines of credit to small businesses to reduce emissions.

Simple ways to Get Started Today

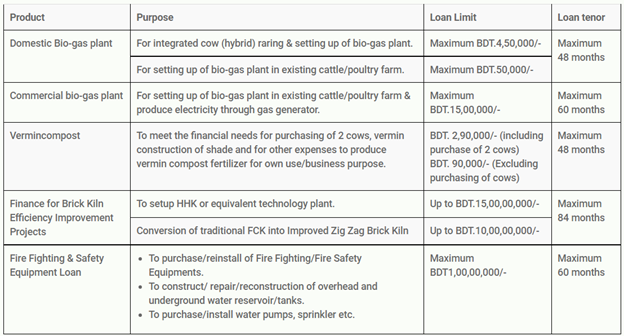

- Commercial biogas plant

- Domestic Bio-gas plant

- Vermicompost fertilizer

- Finance for Brick Kiln Efficiency Improvement Projects

- Fire Fighting & Safety Equipment Loan.

The following table shows the key features of Green Earth Banking

FAQs

What are green banking products and services?

- Commercial biogas plant

- Domestic Bio-gas plant

- Vermicompost fertilizer

- Finance for Brick Kiln Efficiency Improvement Projects

- Fire Fighting & Safety Equipment Loan.