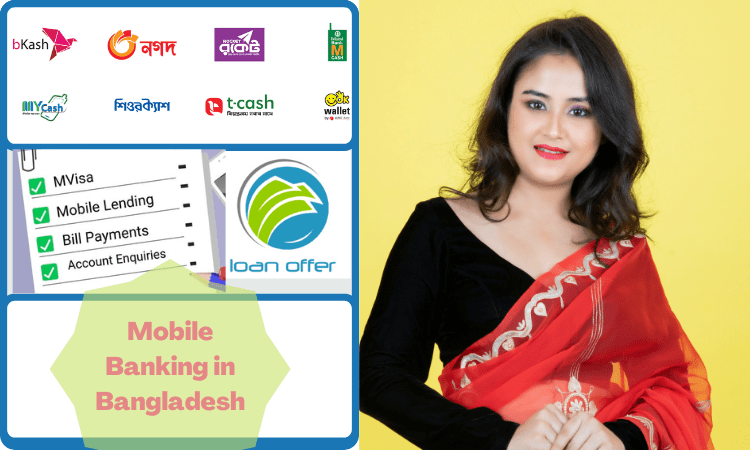

Mobile Banking Service in Bangladesh

Mobile banking (m-banking) refers to accessing banking and financial services through a mobile device. This service enables customers to check their account balances, conduct online transactions, transfer funds, and pay bills without having to visit a bank branch.

Key Features of Mobile Banking

- Mobile refers to the use of a smartphone or tablet device to perform banking activities, which are managed by a mobile application USSD, or SMS.

- A customer can view all his account details and can transfer funds, monitor, invest, apply or repay loans, file necessary complaints, etc.

- It helps customers to access banking services easily, quickly, and conveniently anytime, anywhere through the internet.

- Security is of course very important to get digital banking so it is susceptible to online fraud but security features like two-step OTP verification through message or email and biometric login and two-step OTP verification are also used for every transaction.

Explanation of Mobile Banking

The busy lifestyle and modernity of the present digital age have forced people to opt for mobile banking. Where voice service is being operated as a general service only. Mobile banking has become an easy, fast, and hassle-free service to get round-the-clock banking services. M-banking has modernized and simplified financial services, but internet banking has not reached such a convenient place. Banking services are secure and comfortable through mobile application technology. A customer no longer has to visit a bank branch for financial needs; Customers use m-banking through a USSD, SMS, or mobile app to access banking services.

To access m-banking, customers first need to download the bank’s m-banking app from the App Store. Then, create an online account to register. Once the account is created, a username and password will be given from the bank. Then the customer will go to the specified portal and log in with a username and password which must be verified by OTP. OTP must be verified through message or email to be used every time for a transaction.

Customers can do all financial transactions using the mobile app. This includes online shopping, paying utility bills, checking account information, transferring funds, booking tickets, and all services through digital channels.

Types of Mobile Banking Services

M-Banking provides customers with various financial services such as accessing account information, transactions, investments, availing loans, support services, and necessary communication with bank representatives.

Account Information

An account holders can:

- Information such as bank statements and account details

- Enable or disable SMS alerts during transactions

- Managing Deposit Accounts

- Know loan details and statements

- Get debit and credit card details.

Customer Support

- Account holders can view their ATM card and credit card rewards points checks and statements of checkbooks and cards from the banking app.

Transactions

- Customers can transfer funds between their self-managed accounts, make payments to third-party bank account holders and make utility bill payments, and premiums using mobile-based applications.

Loan Facility

- Some banks offer loan management windows to their customers. Using the app-based mobile utility, customers can get small digital loans, check their loan status, and even pay their EMIs. Payments and loan repayments.

Invest

- Many banks offer the facility of managing investments such as deposits, and insurance from their m-banking interface by embedding services through apps.

Customer Service

- Customers can report fraud or service issues on their accounts using the app.

Advantages and disadvantages of M-Banking

As with the use of technology, m-banking can be both beneficial and detrimental to customers. Therefore, the customer must know its pros and cons to stay safe.

| Advantages | Disadvantages |

| · Offers 24-hour access to banking hence saving time · Provides a convenient way to transfer funds and make payments · Enabling easy tracking and monitoring of bank accounts · Facilitates quick reporting of any illegal transactions or fraudulent activities · Resolve customer complaints faster and speed up request processing · Payment for online purchases is possible · Allows for hassle-free management of investments · Utility bill or loan repayment facility available. | · Difficulties for account holders who are less tech-savvy · Removes human contact from bank branches · Concerns for security and opportunities for online fraud · Small mistakes can result in transaction delays or losses · A complicated app interface creates comprehension issues · In case of internet problems, the service stops completely and delays the service request. |

Frequently Asked Questions (FAQs)

What is the purpose of mobile banking?

- Mobile banking allows its clients to conduct financial transactions remotely using a mobile device.

What is the difference between Internet banking and Mobile banking?

- Internet banking always needs an internet connection along with a desktop or PC or a smart device for its execution and Mobile banking is different from Internet banking. M-banking can be done using a mobile app, SMS, or USSD.

What are mobile banking’s advantages and disadvantages?

- Advantage: Mobile banking permits 24/7 to funds, a convenient way of paying bills, taxes, and loans.

- Disadvantage: The highest disadvantage of mobile banking is potential security risks, tech issues, and extra charges for services.

Which is safer online or mobile banking?

- Online banking is less secure than a bank’s mobile app.

আমার ৫০ হাজার টাকা লোন লাগবে